what is the income tax rate in dallas texas

2020 HUD Income Limits. Dubbed the Great Inflation by the Fed stretched nearly two decades from 1965 through 1982.

Ad Compare Your 2022 Tax Bracket vs.

. 2022 Tax Rates Estimated 2021 Tax Rates. Also called a privilege tax this type of income tax is based on total business revenues exceeding 123 million in 2022 and 2023. Texas has a 625 percent state sales tax rate a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 820 percent.

For instance an increase of 100 in your salary will be taxed 2965 hence your net pay. Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses. Truth in Taxation Summary.

For instance an increase of 100 in your salary will be taxed 2965 hence your net pay will only increase by 7035. 2021 Tax Year Rates. Texas does not have an individual income tax.

Texass tax system ranks 14th overall on our 2022 State. The average yearly property tax paid by Dallas County residents amounts to about 43 of their yearly income. Tax Rate retail or wholesale 0375.

1 2 3 4 State mandated exemption is 10000. If your normal tax rate is higher than 22 you might want to ask your employer to identify your supplemental wages separately and tax them at that 22 rate. Aug 4 2022.

If you make 70000 a year living in the region of Texas USA you will be taxed 8387. HUD literature refers to the 80 of AMFI standard as low income and the 50 standard as very low income. They can either be taxed at your regular rate or at a flat rate of 22.

Wayfair Inc affect Texas. 7500 50 - 69 Disability. The HUD definition.

The Dallas sales tax rate is. DALLAS Texas is one of the most popular relocation states for high-income earning families according to an analysis of tax filing data for 2019-20. Dallas Texas sales tax is a rate of tax a consumer must pay when purchasing goods and some services in Collin Denton Kaufman and Rockwall counties Texas and that a business must collect from their customers.

At the current rate of 773 cents per 100 Dallas has one of the highest property tax rates in the state. Multifamily Tax Subsidy Project Income Limits. Your average tax rate is 165 and your marginal tax rate is 297.

Texas state income tax rate for 2022 is 0 because Texas does not collect a personal income tax. The Lone Star State ranked. Texas does not have a corporate income tax but does levy a gross receipts tax.

SCHOOL DISTRICTS 70 -100 Disability. 100 rows TOTAL TAX RATE. If passed the average Dallas homeowner a 410000 dollar home would have a property tax bill of 2123.

Your average tax rate is 1827 and your marginal tax rate is 2965. Texas Income Tax Rate 2022 - 2023. For the 31000-51000 income group state and local.

Berkshire Park PID 17. 10000 2020 AD VALOREM TAX RATES FOR DALLAS COUNTY. Tax Rate other than retail or wholesale 075.

In 2021 Houston San Antonio and Austin all. Your average tax rate is 1198 and your marginal tax rate is. 12000 30 - 49 Disability.

The minimum combined 2022 sales tax rate for Dallas Texas is. Contact Mariner Wealth Advisors for assistance in making this transition. Because every little bit helps lets take a look.

Did South Dakota v. The Dallas sales tax rate is. Your 2021 Tax Bracket to See Whats Been Adjusted.

Discover Helpful Information and Resources on Taxes From AARP. The County sales tax rate is. Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Texas does not have a corporate income tax but does. Ad Download our checklist to learn about establishing a domicile in a tax-advantaged state.

Ad Compare Your 2022 Tax Bracket vs. Inflations Long History A prolonged period of inflation in the US. The rate increases to 075 for other non-exempt businesses.

That is 79 cheaper than under the current rate. Texas state income tax rate table for the 2022 - 2023 filing season has zero income tax brackets with a TX tax rate of 0 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. Texas state income tax rate for 2022 is 0 because Texas does not collect a personal income tax.

What is the sales tax rate in Dallas Texas. The base Dallas Texas sales tax rate is 1 and the Dallas Texas sales tax rate Dallas MTA Transit is 1 so when combined with the Texas sales tax rate of. Collin Dallas Denton Ellis Hunt Kaufman and Rockwall.

Inflation rose steadily from under 2 percent in 1965 increasing to 11 percent in 1974 and peaking at 136 percent in 1980 Exhibit 1At the core of the Great Inflation were numerous fiscal strains on the economy. This is the total of state county and city sales tax rates. The Dallas TX HUD Metro FMR Area consists of the following counties.

The minimum combined 2022 sales tax rate for Dallas Texas is. 1 day agoThe citys general fund budget is proposed to increase to 17 billion roughly 112 more than the current budget thanks in large measure to. Top individual income tax rate in Texas still 0 in 2020.

The Texas Franchise Tax. The minimum combined 2022 sales tax rate for Dallas Texas is. Notice of Tax Rates Form 50-212 Tax Rate and Budget Information Tax Code 2618 For more information related to Dallas County tax rates please visit the Dallas County Tax Office website.

The Texas sales tax rate is currently. Excess exemption value reported is a local jurisdiction option.

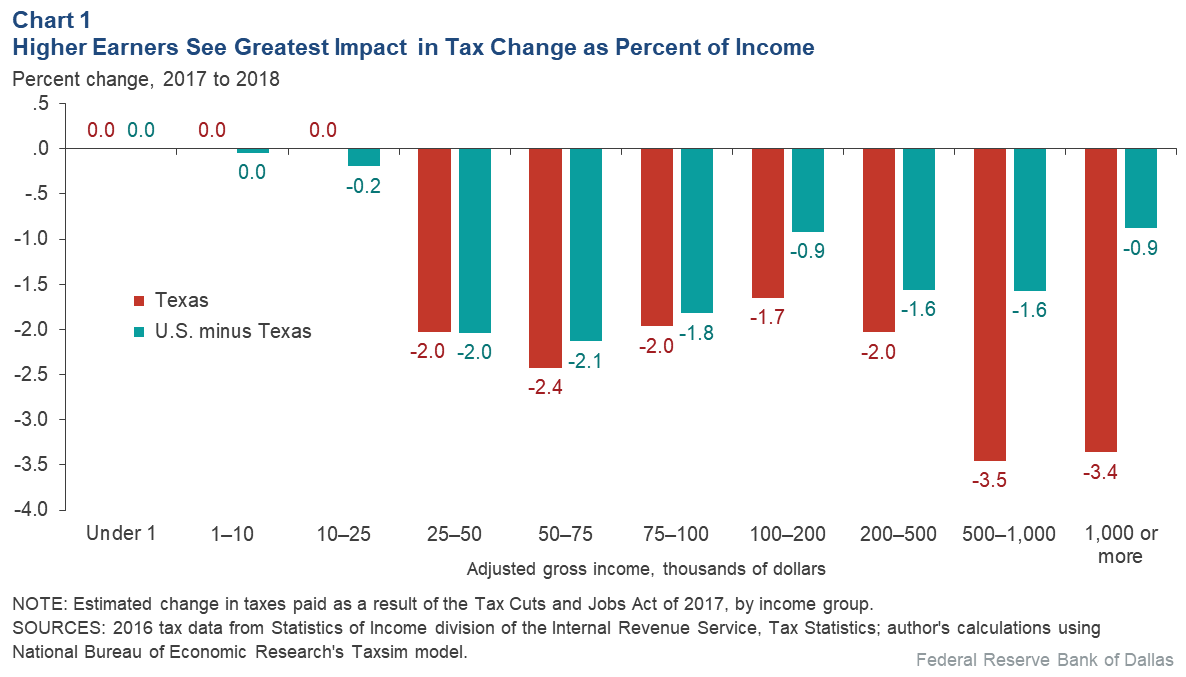

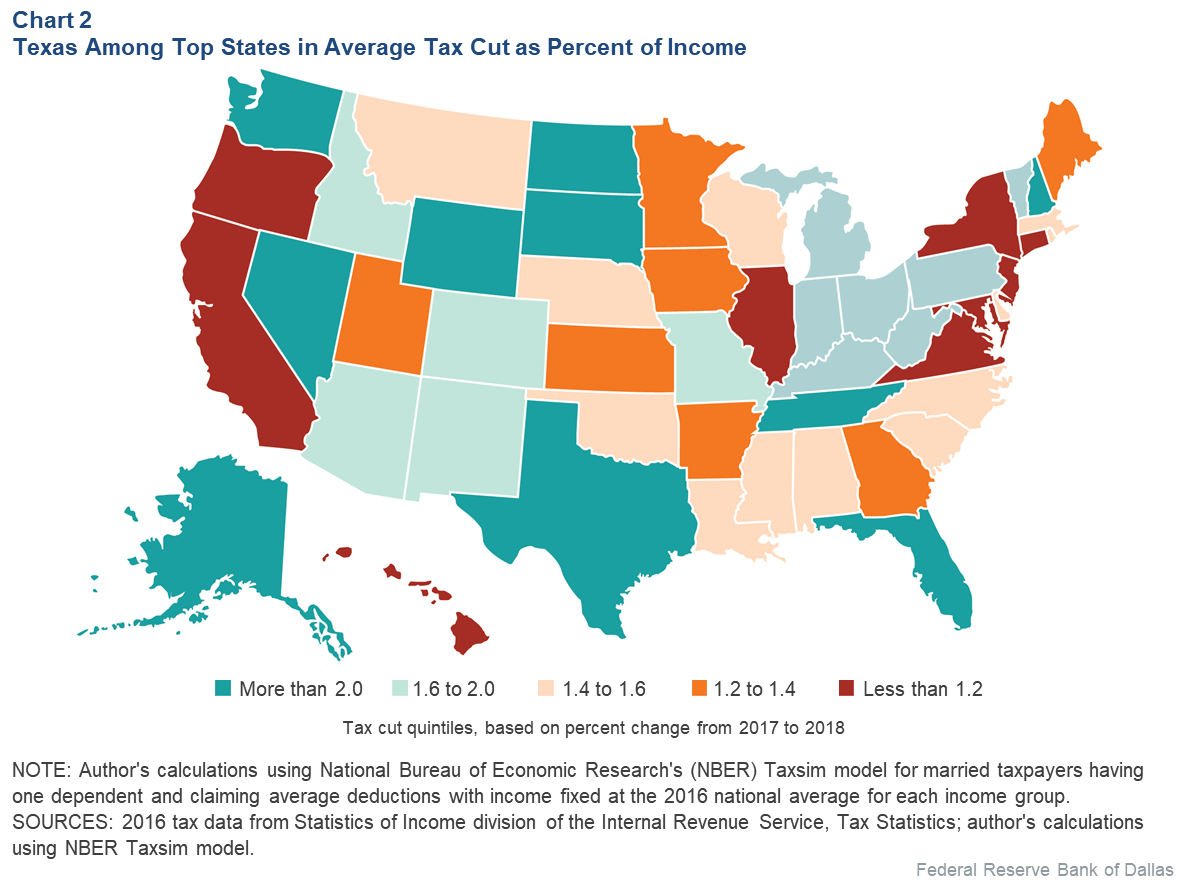

Texas Sees Job Output Gains From 2018 U S Tax Cut Dallasfed Org

Texas Income Tax Calculator Smartasset

Businesses Likely To Get Advance Tax Reduction Irs Taxes Tax Debt Tax Reduction

Texas Income Tax Calculator Smartasset

Dallas Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Bookkeeping Business Plan Template Google Docs Word Apple Pages Template Net In 2022 Bookkeeping Business Business Launch How To Plan

Crna Salary In Montana Nurse Anesthetist Salary Montana

Top 15 Things To Know About Living In Dallas Before Moving

Learn About Dallas County Property Taxes

States Like Texas With No Income Tax Not Always More Affordable Study Says Dallas Business Journal

Texas Income Tax Calculator Smartasset

Texas Busy Practice Just Outside Of Dallas Seeking A Dermatologist High Earning Potential Forney Tx Texas Jobs Dermatology Job

Where Do My Taxes Go H R Block Consumer Math Business Leader Financial Planning

Texas Sees Job Output Gains From 2018 U S Tax Cut Dallasfed Org